VIETNAM

Exporting to Vietnam: A Complete Guide for Global Traders

Introduction

Vietnam is one of Southeast Asia’s fastest-growing economies, offering strong opportunities for exporters worldwide. This guide will walk you through the key steps, regulations, and considerations for exporting to Vietnam.

Vietnam’s booming economy—projected to grow at 6-7% annually through 2030—presents a prime opportunity for U.S. exporters. With a population of over 100 million, a rising middle class, and increasing demand for high-quality American goods, bilateral trade hit $155.1 billion in 2024, up 20.5% from 2023. U.S. goods exports to Vietnam reached $13.1 billion in 2024, a 32.9% surge from the prior year, driven by agricultural products, machinery, and aircraft. Despite a persistent U.S. trade deficit of $123.5 billion with Vietnam in 2024, recent 2025 developments, including a landmark U.S.-Vietnam trade framework announced on July 2, have slashed tariffs on U.S. imports to Vietnam to 0%, opening doors wider than ever.

Tap into Vietnam – Your Gateway to ASEAN Trade

Practical insights and tools for U.S. businesses exporting to Vietnam — one of Southeast Asia’s fastest-growing markets.

This guide equips American companies with actionable insights to navigate the market, streamline exports, and capitalize on these shifts. Whether you’re in agriculture, tech, or manufacturing, Vietnam’s WTO commitments and the 2001 U.S.-Vietnam Bilateral Trade Agreement (BTA) provide a stable foundation for growth.

Why Vietnam?

Booming economy (6%+ annual growth)

ASEAN trade hub (access to 600M+ consumers)

U.S.–Vietnam trade volume exceeded $100B

Strategic sectors: electronics, agri-food, machinery, healthcare

Why Export to Vietnam Now?

- Market Potential: Vietnam ranks as the 9th-largest U.S. agricultural export market and a hub for electronics and machinery demand. Urban consumers in Hanoi and Ho Chi Minh City favor premium U.S. brands for quality and innovation.

- Trade Boost from 2025 Deal: The July framework eliminates tariffs on U.S. goods entering Vietnam, while addressing transshipment concerns (e.g., 40% duties on rerouted Chinese products). This reciprocity builds on Vietnam’s proactive tariff cuts via Decree 73/2025/NĐ-CP, reducing duties on 16 U.S. product categories like soybeans and aircraft parts.

- Supply Chain Shift: As firms diversify from China, Vietnam’s “China+1” strategy amplifies demand for U.S. inputs in manufacturing.

Why Export to Vietnam?

- Rapidly growing middle class and consumer demand

- Strategic location in ASEAN with trade agreements

- Improving business climate and infrastructure

- Demand for high-quality foreign products (machinery, food, cosmetics, etc.)

As compared to other ASEAN countries:

- Rapid Economic Growth: Often exceeding 6% annually, making it one of the fastest-growing economies in the region.

- Manufacturing Hub: The country is a major manufacturing center.

- Young Workforce: A large, youthful population offers a skilled and adaptable workforce.

- Strategic Trade Agreements: Vietnam has entered numerous free trade agreements, including the CPTPP and the EU-Vietnam Free Trade Agreement.

- Political Stability: Vietnam enjoys a relatively stable political environment.

- Cooperation: The U.S. enjoys a comprehensive strategy partnership.

- Growing Middle Class: A burgeoning middle class increases domestic demand for goods and services.

- Median Age: 33.1 years (2024 est.)

- 50% of the population is below age 35

- 67% of the population is below age 45

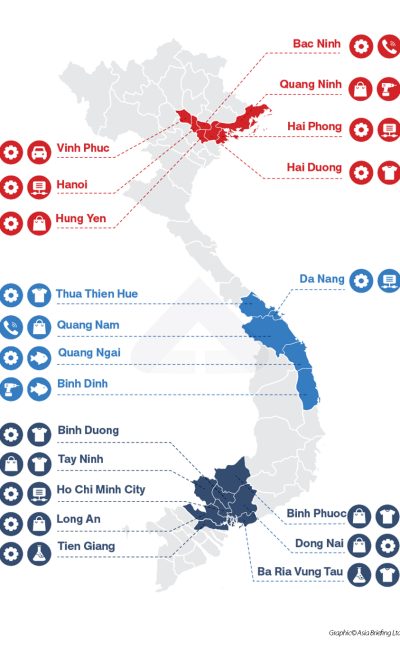

Economic Areas

Northern Area: Hanoi

- Economic Growth: GDP growth rate consistently above the national average as the city transformed into an attractive economic hub.

- Diverse Industries: Key sectors including manufacturing, services, information technology, and tourism and is home to numerous industrial parks and export processing zones.

- Foreign Investment: The government offers various incentives to attract foreign businesses.

- Population: about 8.5 million

Central Area: Da Nang

- Strategic Location :A transportation hub located on the central coast of Vietnam, provides key international logistics and proximity to major cities.

- Growing Tourism Industry: The tourism sector significantly contributes to the local economy, attracting investments in hospitality, restaurants, and related services.

- Emerging Technology Hub: A center for technology and innovation, with an increasing number of tech startups and IT companies establishing operations there.

- Population: About 1.5 million

Southern Area: Ho Chi Minh City

- Economic Center: The largest economic hub in Vietnam, contributing around 20% of the country’s GDP and serving as the focal point for commerce, finance, and trade.

- Diverse Industries: Key sectors include manufacturing, technology, finance, and retail. Home to numerous multinational corporations, local businesses, and a vibrant startup ecosystem.

- Trade and Logistics: With its well-developed infrastructure, it’s one of the busiest ports in Southeast Asia, making it a crucial logistics and trade center enhancing its status as a commercial powerhouse.

- Population: Approximately 13 million

Economic Overview

- Vietnam’s GDP growth (%) in the second quarter of 2024 accelerated to a stronger-than-expected 6.9% increase, from 5.7% in the first quarter.

- GDP ($) is forecasted to reach $460 billion in 2024 and $499 billion in 2025.

- 2023 GDP($) per capita was $4,000 and forecasted to reach $4,900 in 2025.

- Population hit 100 million people in April 2023, third most in Southeast Asia.

- Vietnam’s advantages and strengths include a strong export-oriented economy, diverse sources of foreign direct investment, vigorous inter-provincial competition, and a skilled workforce with high education levels.

- Vietnam faces challenges such as credit weaknesses, energy and water shortages, and sluggish progress in green infrastructure development.

- Foreign investors are gradually vying for Vietnam’s domestic market. The large population offers a potential consumer market, fueled by an expanding middle class and rising domestic spending.

Step-by-Step Guide: How to Export to Vietnam

U.S. companies can engage in direct import/export without a separate license, thanks to WTO rules and the BTA. Here’s a streamlined process

Market Research & Entry Strategy:

- Target north (Hanoi: government-focused) vs. south (Ho Chi Minh City: industrial hub)

- Use U.S. Commercial Service (USCS) for free counseling—offices in Hanoi and HCMC connect you to buyers.

- Partner via agents/distributors or joint ventures; e-commerce platforms like Shopee.vn are booming for consumer goods.

Compliance & Documentation:

- Tariffs/Barriers: Most U.S. goods now enter at 0% duty under the 2025 deal, but check Vietnam’s average MFN rate of 9.4% for specifics (e.g., via Decree 73). Non-tariff barriers include labeling (Vietnamese required for food/pharma) and testing for restricted items like electronics.

- Key Documents: Commercial invoice, bill of lading, packing list, certificate of origin (for preferential treatment), and import code registration. For ag products, secure USDA/FDA certifications.

- U.S. Export Controls: Comply with EAR/BIS for dual-use items; no major restrictions for Vietnam beyond standard checks.

- Prohibited/Restricted: No bans on U.S. goods, but avoid cultural sensitivities (e.g., no political content).

Logistics & Customs Clearance:

- Ship via sea (Haiphong port) or air (Tan Son Nhat); full container loads clear in 1-3 days.

- Use VNACCS (Vietnam’s electronic customs system) for declarations; hire a local forwarder for efficiency.

- Payment: Letters of credit or wire transfers; Vietnam’s banking is digitized but verify via U.S. Embassy.

Risk Mitigation:

- Currency: VND is stable, but hedge USD fluctuations.

- IP Protection: Register trademarks via NOIP; U.S.-Vietnam ties strengthen enforcement.

- Local Presence: Start with a representative office; scale to a branch for direct sales.

Export Requirements

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin

- Import Licenses (for certain goods)

- Customs Declarations (via VNACCS/VCIS system)

Tariffs and Duties

- Vietnam follows the ASEAN Harmonized Tariff Nomenclature (AHTN).

- Products from countries with FTAs (e.g. EU, UK, CPTPP) may qualify for preferential tariffs.

More Tips for Exporters

- Work with a local import partner or distributor

- Use Incoterms correctly (FOB, CIF, etc.)

- Ensure labeling complies with Vietnamese regulations (language, nutrition, safety)

- Monitor changes in trade agreements and duties

U.S.–Vietnam Trade Agreements

- The U.S. and Vietnam do not have a free trade agreement (FTA), but Vietnam is part of CPTPP and ASEAN, offering indirect access to reduced tariffs.

- Tip: U.S. exporters can benefit by partnering with ASEAN distributors or routing through Singapore/Malaysia hubs.

Market Entry Tips

- Partner with a local Vietnamese importer

- Use trusted freight forwarders familiar with VN customs

- Join trade missions or events via US Commercial Service

- Localize packaging, manuals, and labeling in Vietnamese

Need Expert Help?

Get personalized advice on market entry, compliance, and logistics.

Schedule a Free Consultation (808)888-4243

Email: marketing@cosmoworldexport.com

Exporting to Vietnam isn’t just trade—it’s a gateway to Southeast Asia’s growth engine. With zero tariffs and supportive policies, now’s the time to act. For personalized advice, reach out to USCS or consult a trade attorney. Your next big deal awaits!